Market sentiment: "Partial retreat of the pessimists"

While some pessimists have used the pause on the way up to cover their losses, many are still sitting on their losses. In Goldberg's view, a favorable starting position for further price gains.

Summary

The dampener of the price increases since the beginning of the year used a number of medium-term investors to close out their short positions, specifically 10 percent of professionals and 5 percent of private investors. 6 and 5 percent went directly long, the sentiment indices are at -21 and +6 points. The ground under the feet of the bears has become too hot, suspects Joachim Goldberg.

The behavioral economist points to the persistent optimism of the institutional investors. He assumes that they are still too far in the minus, expects demand from this group of investors at the bottom from 14,700/750 points. On the upside, the danger of a massive short squeeze has been somewhat defused. From the high for the year so far at 15,270, he sees many players in buying pressure. Conclusion: The sentiment situation for the DAX remains favorable.

25 January 2023. FRANKFURT (Börse Frankfurt). Since our last sentiment survey, trading activity on the DAX has calmed down noticeably. This is particularly evident from the relatively narrow trading range of 2.3 percent during this period, and a weekly comparison shows a small minus of 0.6 percent. A typical consolidation, one could say, which, by the way, was commented on predominantly skeptically during the reporting period. Even though the DAX has not marked a new high for the year since last Wednesday, the balance sheet for the first month of this year has been positive so far and the share price has gained almost 9.7 percent at times. Although global recession fears have eased somewhat, if the Bank of America fund manager survey from January is to be believed, they are still considered the second largest extreme risk in the assessment of international asset managers after fears of persistently high inflation. And so it's no surprise that many players can't do much with the DAX's strong start to the year.

Pavement has become too hot

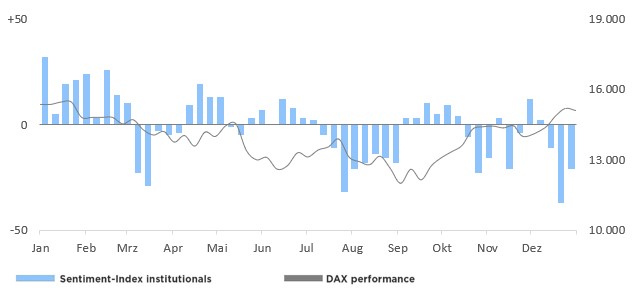

At least the mood among the institutional investors with a medium-term trading horizon surveyed by us has improved compared with the previous week. This is because our Börse Frankfurt Sentiment Index rose by 16 points to a new level of -21. Apparently, for some pessimists the patch has become too hot, so that some have decided to close bearish positions. Since last Wednesday, there was a temporary setback in the DAX of almost 1.8 percent, which was probably used to buy back. The bear camp has shrunk by 10 percentage points in the process, with 60 percent of the former pessimists immediately switching to the bulls, while the rest have joined the neutral-minded players.

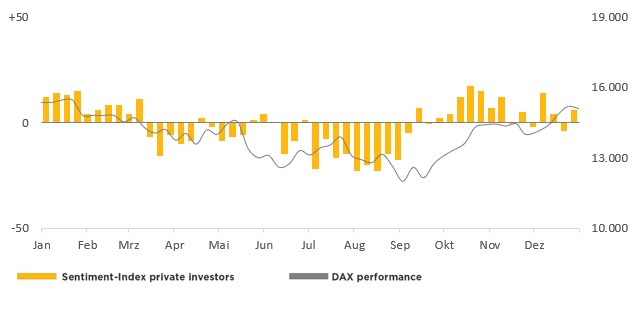

The picture is similar for private investors, as the Börse Frankfurt Sentiment Index in this panel has risen by 10 points and now stands at +6. In the process, 5 percent of all respondents - we suspected in the previous week behind rather short-term oriented players of a similar magnitude - have directly turned their position from "short" to "long". In other words, this relatively active small group has again presumably done quite well, i.e.: profitably.

Private investors slightly optimistic

With today's survey, the sentiment gap between private and institutional investors has narrowed again somewhat. Nevertheless, sentiment among the latter remains conspicuously negative. Even the decline in the negative sentiment index from 16 points to a level of

-21 changes very little. This is because the sentiment barometer was only able to recover part of its decline from the previous week. Presumably also only those became active as repurchasers, who had come out of their commitment with whole skin. The remaining bears need a DAX of still probably 14,700/750 points for halfway profitable or loss-free buybacks at lower levels. This is also the level at which we expect primarily demand from these sources.

At least, with today's questioning, the situation on the upside, the danger of a massive short-squeeze due to the interim buybacks of some pessimists, has been somewhat defused. Nevertheless, the remaining bears would probably not idly watch a renewed DAX rise. This could already be the case if the stock market barometer were to significantly exceed the previous high for the year (around 15,270 points). All in all, the sentiment situation for the DAX remains favorable.

25 January 2023, © Goldberg & Goldberg für boerse-frankfurt.de

Sentiment-Index institutional Investor

| Bullish | Bearish | Neutral | |

| Total | 28% | 49% | 23% |

compared to last survey | +6% | -10% | +4% |

DAX (Change from previous survey): 15.090 (-90 points)

Börse Frankfurt Sentiment-Index institutional Investors: -21 points (+16 points to the previous week)

)

Sentiment-Index private Investor

| Bullish | Bearish | Neutral | |

| Total | 41% | 35% | 24% |

compared to last survey | +5% | -5% | +0% |

DAX (Change from previous survey ): 15.090 (-90 points)

Börse Frankfurt Sentiment-Index private Investors: +6 points (+10 points to the previous week)

)

About the Frankfurt Stock Exchange Sentiment Index

The Börse Frankfurt Sentiment Index ranges between -100 (total pessimism) and +100 (total optimism), the transition from positive to negative values marks the neutral line.

Weitere Artikel dieses Kolumnisten

| Uhrzeit | Titel |

|---|