Market sentiment: "Relay of the Optimists"

While professionals are still hesitating, many private investors are switching into bull mode. For Goldberg, 2023 is still undescribed and full of potential from a behavioral finance perspective.

Summary

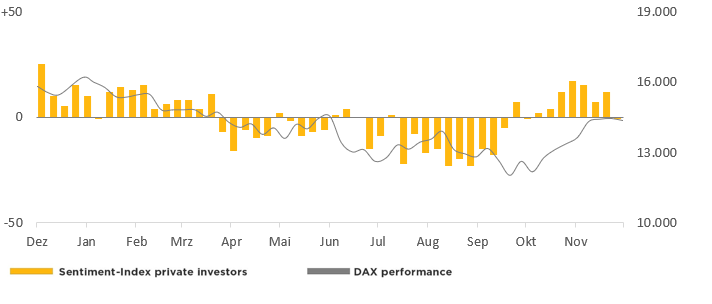

2023 starts with a strong increase in the share price. The professional investors here did not play a significant role. 5 percent have switched from long to short. Joachim Goldberg reminds us that this group has set its clocks to zero and can reassess the situation on the market unencumbered. With divided expectations, the behavioral economist suspects. The situation is different for private investors. Their optimism has increased significantly with +9 percent. The sentiment index of these participants is at +16 points, while that of the professionals with +2 a slightly pessimistic note. "I wonder if the mild weather has helped to reassess the energy situation in this country and the resulting implications for growth and inflation."

The bottom line for Goldberg is that the market is encouragingly free of inhibiting positions. If positive sentiment prevails among long-term investors, nothing would stand in the way of further gains.

4 January 2023. FRANKFURT (Börse Frankfurt). Many stock market players have probably returned to their workplaces from their Christmas vacation (also on the other side of the Atlantic) and seem to want to get an overview and orientation first. One could get the impression that since Christmas week last year, analyses and commentaries had been doing the rounds that were only really worked through yesterday. But in the end, the questions that remained urgent for 2023 were how inflation and growth will develop on a global level. Clues as to where the journey is headed could be found as early as this week, when the U.S. labor market report is published on Friday. The minutes of the last meeting of the Federal Open Market Committee of the U.S. central bank could also give one or the other player a hint as to the Fed's future monetary policy stance.

After all, since our last sentiment survey, those players who were optimistic at the time have been able to enjoy a price gain of around 2.6% (as of the reporting date) - the total trading range during this period was around 3.6%.

... from institutional to private investors

Meanwhile, among the institutional investors with a medium-term trading horizon we surveyed, sentiment has deteriorated significantly since the last survey two weeks ago. This is because our Börse Frankfurt Sentiment Index has fallen by 10 points to a new level of +2. Even if, at first glance, a migration of 5 percent of all respondents from the bull to the bear camp and thus a slightly bearish note among a small group results, this change probably largely takes into account the fact that with the turn of the year, the clocks were set to zero in many places, so to speak. In other words, profits and losses accumulated up to that point were mentally booked out.

The mood among private investors, however, was quite different. The Frankfurt Stock Exchange Sentiment Index rose significantly in this panel by 16 points to a new level of +14. Apparently, a group of previously bearish players - 7 percent of all private investors surveyed - used the turn of the year to fundamentally re-evaluate their commitments and, on balance, joined the bulls. The latter gained 9 percentage points and also benefited from previously neutral players.

Institution-als on the defensive

Today's survey has thus revealed a new gap in sentiment between private and institutional investors. While the former were still much more pessimistic than their institutional counterparts at the end of last year, this difference has now reversed. In a figurative sense, former institutional bulls have passed the baton to private investors. It is remarkable that private investors, of all people, who are not under pressure to show their performance at the end of the year, are so optimistic. Especially since there have hardly been any really favorable entry opportunities for share purchases since our last sentiment survey. Whether the mild weather has helped to reassess the energy situation in this country and the resulting consequences for growth and inflation?

On balance, institutional investors seem to be divided on this point, which means that the DAX did not suffer any significant position-related burdens at the beginning of the year. Should a positive mood prevail among long-term investors and the capital flows possibly associated with it, as is the case with our domestic private investors, there would be little to prevent the stock market barometer from experiencing a new upward impulse.

4 January 2023, © Goldberg & Goldberg für boerse-frankfurt.de

Sentiment-Index Institutional Investors

| Bullish | Bearish | Neutral | |

| Total | 40% | 38% | 22% |

| compared to last survey | -5% | +5% | +0% |

DAX (Change from previous survey): 14.350 (+370 points)

Börse Frankfurt Sentiment-Index Institutional Investors: +2 points (last survey: +12 points)

Sentiment-Index private Investors

| Bullish | Bearish | Neutral | |

| Total | 48% | 34% | 18% |

| compared to last survey | +9% | -7% | -2% |

DAX (Change from previous survey): 14.350 (+370 points)

Börse Frankfurt Sentiment-Index Private Investors: +14 points (last survey: -2 points)

About the Frankfurt Stock Exchange Sentiment Index

The Börse Frankfurt Sentiment Index ranges between -100 (total pessimism) and +100 (total optimism), the transition from positive to negative values marks the neutral line.

Weitere Artikel dieses Kolumnisten

| Uhrzeit | Titel |

|---|