Market sentiment: "One man's joy, another man's sorrow"

[Translate to English:]

[Translate to English:]

Der DAX ist auch in der vierten Woche hintereinander gestiegen, aber zwischen den Privatanlegern und institutionellen Investoren ist man scheinbar geteilter Meinung darüber, wie es weitergeht.

[Translate to English:] Zummenfassung

[Translate to English:]

Auch wenn der DAX seit der Sentiment-Erhebung der vergangenen Woche um 2 Prozent und das vierte Mal hintereinander zulegen konnte, scheinen die Marktteilnehmer zunehmend geteilter Meinung zu sein, ob sich die Rallye des Börsenbarometers fortsetzen wird oder nicht. Während einige institutionelle Investoren im Laufe der vergangenen Wochen satte Gewinne einstreichen konnten und sich anschließend zunehmend zurückzuziehen begannen, scheint zumindest ein Teil der Privatanleger dem DAX an der Oberseite noch mehr zuzutrauen. Zweckoptimismus? Schließlich erfolgte bei manchen der Einstieg in bullishe Positionen reichlich spät. Aber die vermeintlichen Differenzen lösen sich bei genauerem Hinsehen auf: Beide Panels scheinen Ähnliches im Schilde führen.

2 November 2022. FRANKFURT (Börse Frankfurt). Since our last sentiment survey, two important events have influenced trading activity. The first, of course, was the U.S. midterm congressional elections, the outcome of which, however, had only been partially determined by the end of our survey. After all, until then it looked as if the Democrats were very likely to lose their majority in the House of Representatives, while the race for the seats to be distributed in the Senate remained open.

The other important event, on the other hand, took place a week ago: the outcome of the meeting of the Federal Open Market Committee of the U.S. Federal Reserve, which was perceived by stock market participants in this country as surprisingly hawkish. As a result, the stock markets on both sides of the Atlantic lost ground, with the local DAX losing around 2.1 percent. But only to recover all the more impressively afterwards (by around 5.1 percent at times). There are quite a few commentators who are no longer talking about a rally in a bear market, but rather about the start of a year-end rally. Not least because the stock market barometer has at times risen by more than 15 percent since the end of September.

Positive pressure to take profits

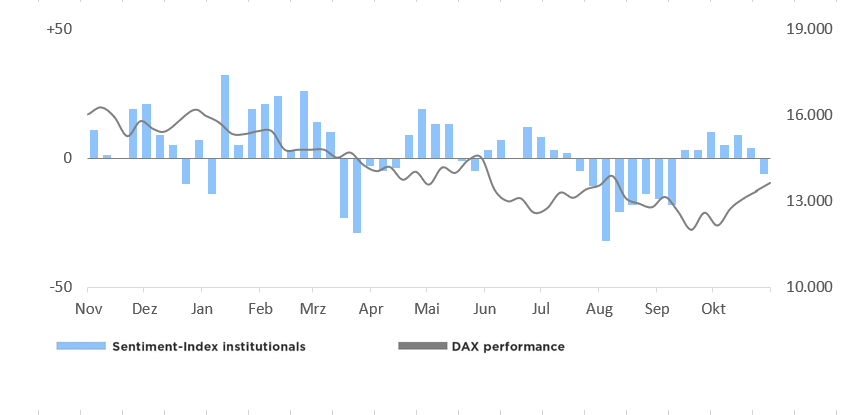

Meanwhile, sentiment among institutional investors with a medium-term trading horizon surveyed by us deteriorated by 10 points compared with the previous week to a new level of -6. This change in sentiment is due to a group of investors - 5% of all respondents on balance - who not only realized profits from bullish engagements, but went directly to the bear side and thus turned their positions by 180°. It is quite possible that some are of the opinion that the DAX has risen too much in too short a time.

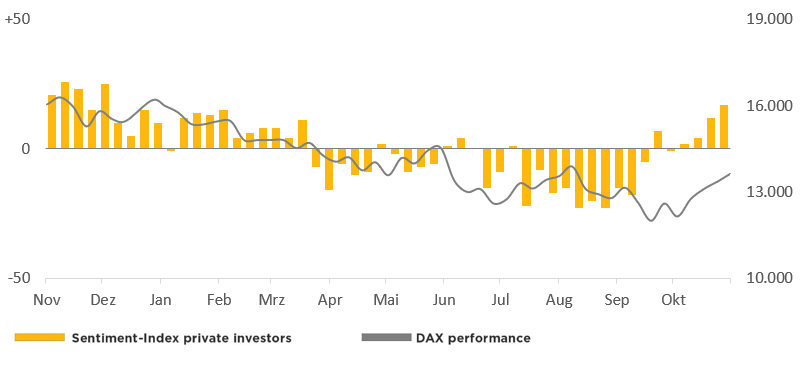

The mood among private investors, however, is quite different, with the Börse Frankfurt Sentiment Index rising by 5 points to a new level of +17, its highest level so far this year. This is the fourth time in a row that the index has risen in this panel. A look at the past four weeks shows that it was almost entirely previously pessimistic investors (around 9 percent of all respondents) who threw in the towel and even went directly to the bull side despite a rising market, especially during the past two weeks.

So different the starting position - so different the reaction

Today's survey has significantly widened the gap in sentiment between institutional investors and private investors. Particularly among the latter, the change in sentiment in recent weeks can obviously not only be explained as a mini-capitulation of former pessimists. Rather, a certain concern seems to be spreading among this panel that the DAX may have meanwhile completed a trend reversal.

For the institutional counterparts, who were originally much more optimistic during the past four weeks, the positive pressure to realize these gains increased in view of the profits accumulated in the meantime (around 12 percent on the reporting date). Away from all thoughts of a possible year-end rally. This does not necessarily mean that these institutional investors have already written off such a rally. Rather, in the event of a decent DAX setback (possibly for the first time in the 13,150/13,200 area), we expect recent bearish engagements to be covered. It is precisely these potential demanders that could provide additional support for the DAX - in addition to possible long-term capital inflows.

9. November 2022, © Goldberg & Goldberg for boerse-frankfurt.de

Video-Kommentar von Joachim Goldberg

Sentiment-Analyse jetzt auch als Podcast

Sie können sich die Sentiment-Analyse direkt über diese Seite anhören oder herunterladen. Es gibt sie natürlich auch auf den üblichen Podcast-Plattformen Spotify, iTunes, Podcaster, Amazon, Google, auf denen Sie ihn abonnieren können.

Sentiment Index of Institutional Investors

| Bullish | Bearish | Neutral | |

| Total | 36% | 42% | 22% |

| compared to last survery | -5% | +5% | +0% |

DAX (change to last survery): 13.620 (+270 points)

Börse Frankfurt Sentiment index institutionelle investors: -6 points (last survery: +4 points)

Sentiment index of private investors

| Bullish | Bearish | Neutral | |

| Total | 48% | 31% | 21% |

| compared to last survery | +2% | -3% | +1% |

DAX (change to last survery) 13.620 (+270 points)

Börse Frankfurt Sentiment index private investors: +17 points (last survery: +12 points)

About the Börse Frankfurt Sentiment Index

The Börse Frankfurt Sentiment Index ranges between -100 (total pessimism) and +100 (total optimism), the transition from positive to negative values marks the neutral line.

More articles from this columnist

| Time | Title |

|---|