Market sentiment: "With the intention of coming back"

Once again, the DAX has strengthened impressively. At the same time, there is no longer a convincing majority for the assumption that we are still in an overriding bear market.

Summary

For the fourth time in a row, the number of optimists among institutional investors has decreased. For some of them, the DAX's dazzling performance since mid-July has even helped them out of earlier slumps. Interestingly, the share of pessimists among institutional investors has nevertheless not increased during the past four weeks. This is because almost all former optimists have moved to the sidelines during this period. Apparently with the intention, Joachim Goldberg suspects, of getting back in at a lower level.

3 August 2022. FRANKFURT (Börse Frankfurt). Since mid-July, the DAX has staged an impressive rally, at times reaching more than 9 per cent, so that some commentators have begun to wonder whether this is still only a recovery in an overriding bear market or whether a turnaround for the better is imminent. Particularly when it comes to the part of the recovery that has taken place since our last sentiment survey and peaked at just under 3.7 per cent, a certain amount of puzzlement may have arisen here and there. Because actually - for better or worse - there were no real surprises. Especially not the outcome of last week's Federal Open Market Committee meeting, which cannot be called anything other than unspectacular.

Meanwhile, we already noted in our last commentary that the players seem to have got used to the big market risks. A commentator recently put it even better in a nutshell by saying that apparently just a little positive news or the absence of bad news was enough to trigger a veritable rally on the stock markets on both sides of the Atlantic.

Bailing out

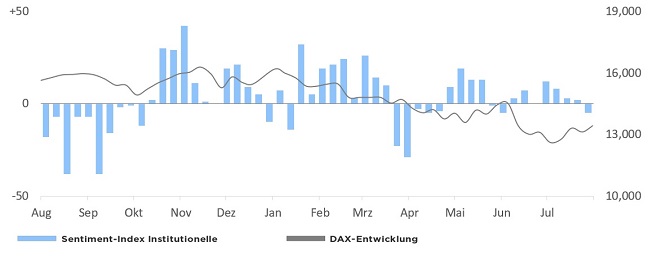

Meanwhile, the institutional investors we surveyed with a medium-term trading horizon have been ridding themselves of bullish positions for the fourth week in a row. This time our Börse Frankfurt Sentiment Index fell by 7 points to a new level of -5. In fact, this development shows that the strong recovery of the DAX now also seems to have bailed out those optimists whose positions had already been under water for weeks. It is possible that some of them got off lightly and were able to close out bullish positions without huge losses.

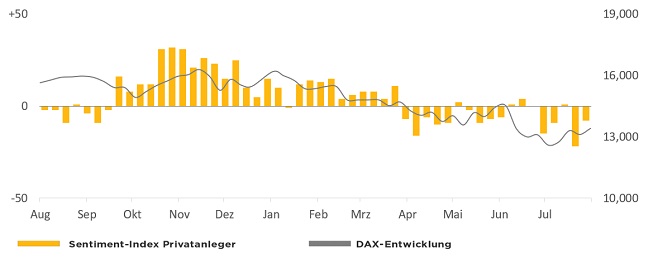

Private investors, on the other hand, were very active. In this segment, some players acted very disciplined and ended their bearish engagements from the previous week in view of the clear rise in the DAX and in some cases even went directly to the bull side. As a result, the Börse Frankfurt Sentiment Index of this panel rose by 14 points to a new level of -8.

Fewer and fewer believe in an overriding bear market

With today's survey, the clear gap in sentiment between private and institutional investors from last week has narrowed to just 3 points. It is particularly noticeable that the change in sentiment among institutional investors has been rather half-hearted. While the group of bulls has now shrunk for the fourth time in a row, the neutrally inclined players have benefited each time - by almost the same amount in total. However, the underlying position reductions of the optimists have on balance had no negative influence on the DAX. On the contrary: the stock market barometer has nevertheless strengthened considerably - presumably also due to long-term capital flows.

But something else also becomes clear. During the four weeks in question, the proportion of pessimists among institutional investors has practically not changed, let alone increased. In fact, there is no convincing majority that believes in the continuation of the overarching bear market. At least today's development in sentiment cannot be considered unfavourable. After all, the optimists who have taken to the sidelines are likely to come back as buyers in the event of an interesting setback of the DAX at lower levels (possibly between 13,000 and 13,050 points for the first time) and provide at least temporary support for the DAX.

3 August 2022, © Goldberg & Goldberg für boerse-frankfurt.de

Sentiment index institutional investors

| Bullish | Bearish | Neutral | |

| Total | 31% | 36% | 33% |

Compared to last survey | +6% | +1% | +5% |

DAX (Change to last survey): 13.420 (+300 points)

Börse Frankfurt Sentiment index institutional investors: -5 points (Status last survey: +2 points)

Sentiment index private investors

| Bullish | Bearish | Neutral | |

| Total | 33% | 41% | 26% |

| Compared to last survey | +6% | -8% | +2% |

DAX (Change to last survey): 13.420 (+300 points)

Börse Frankfurt Sentiment index private investors: -8 points (Status last survey: -22 points)

More articles from this columnist

| Time | Title |

|---|