Market sentiment: "With a clear course in uncertain waters"

The DAX is fluctuating, investors have positioned themselves more strongly, both on the long and short side. Not a good environment from a sentiment perspective, as Goldberg finds.

Summary

According to Joachim Goldberg, most of the medium-term oriented investors in Germany have a clear opinion despite the uncertain geopolitical situation. This is what the behavioral economist concludes from today's result of our sentiment survey. However, in different directions, because while 6 percent of professional investors have bought shares since last Wednesday and 3 percent have gone short, of the private even 10 percent more now bet on falling prices. Thus, sentiment gaps wide.

Goldberg suspects that the majority of the bullish positions of the professionals are under water, the price dips have now been used to cheapen. One waits for 15,450 points to get out. Downward one would have to pull a ripcord from 14,300 points in addition. The situation for the DAX is therefore not exactly favorable in the medium term.

23 February 2022. FRANKFURT (Börse Frankfurt). Just two weeks ago, only a small minority of international fund managers identified the conflict between Russia and Ukraine as a major risk for financial markets. At the time, for example, just 7 percent of respondents to a Bank of America survey had this risk on their radar. This may have been one of the reasons why Russia's escalation in the Ukraine conflict at the beginning of the week - possibly aided by the holiday-related absence of many U.S. market participants last Monday - had triggered sometimes violent reactions on the financial markets.

The fact that Russian President Vladimir Putin's recognition of eastern Ukrainian separatist areas caused shock in many quarters and led to slumps on the stock markets shows that people may have underestimated how far the Kremlin leader would go. However, by the time of today's sentiment survey, the DAX had recovered impressively from its interim price loss of more than 1,000 points since last Wednesday, so that "only" a weekly minus of around 4.2 percent remains in a point comparison.

"Cheap" added

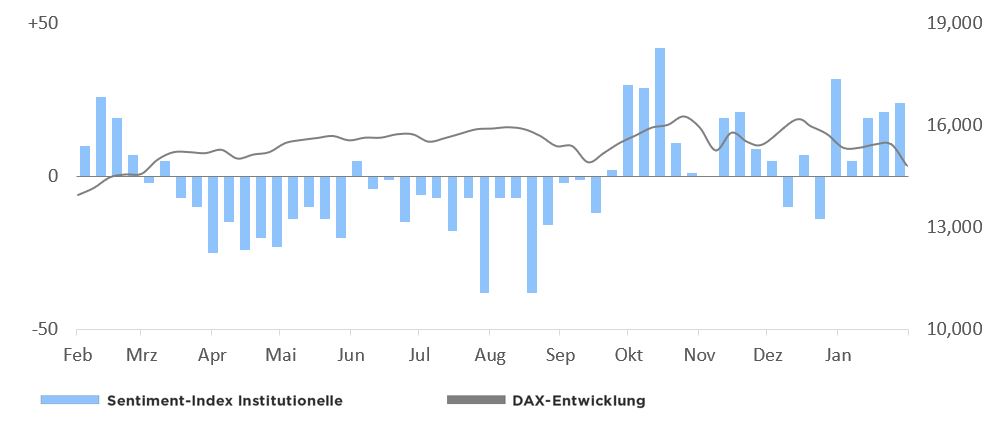

Meanwhile, institutional investor sentiment has even improved somewhat - our Börse Frankfurt Sentiment Index has risen by 3 points compared to the previous week to a new level of +24. What is remarkable here is that the group of players with a neutral sentiment has fallen by over 30 percent compared with the previous week to a three-month low. And the bottom line is that two-thirds of these players have joined the bulls, while the remaining third has increased the size of the bear group. On balance, however, the majority of investors appear to have once again sat out a significant decline in the DAX, possibly adding to existing bullish exposure at lower prices.

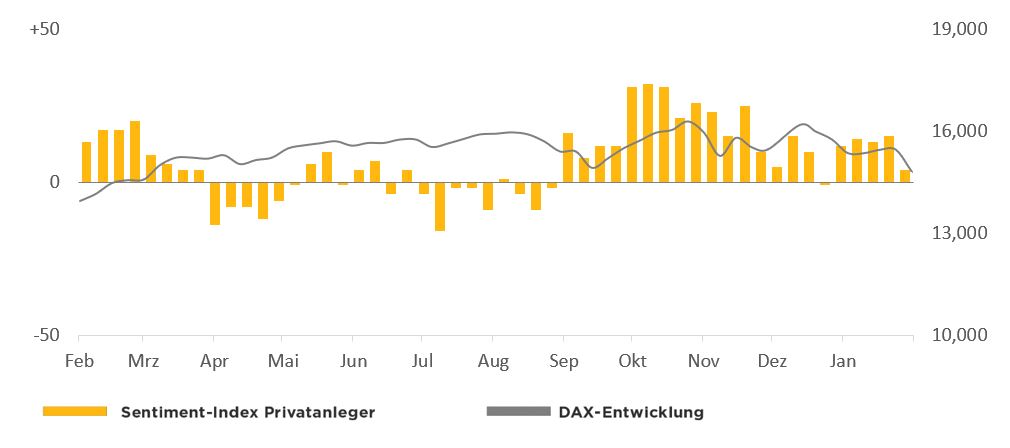

Among private investors, too, the group of investors with a neutral stance has fallen significantly compared with the previous week to a share of only 14 percent of all respondents. This is, after all, the lowest level since April 22, 2020. At the same time, the Börse Frankfurt Sentiment Index in this panel fell by 11 points to a new level of +4. In other words: On the one hand, previously neutral investors have almost completely lined the bear camp. On the other hand, the group of optimists has remained almost as high as in the previous week - obviously, in view of the DAX slump, the emergency brake was pulled only in a few cases.

Today's survey makes two things clear. Although it should be assumed that stock market players have a strong aversion to uncertain constellations, the group of neutral players among both private and institutional investors has decreased significantly. In short, investors predominantly have a clear opinion despite the geopolitically uncertain situation.

On the other hand, a new gap in sentiment has opened up between institutional and private investors. It should be noted that the number of optimists in both groups has actually increased or hardly decreased. However, it is to be feared that a large proportion of the bullish commitments behind these optimistic opinions are now well underwater. Presumably, the majority of optimists would be happy to see once again the DAX level at the survey time of the previous week at 15,450 points, so that on the upside in this area, possibly even before, disruptive closes in the course of any recoveries would be expected. It is also doubtful that the optimists in the majority would stand idly by and watch the DAX fall again (below 14,300 points). In conjunction with possible capital outflows from abroad, the situation for the DAX cannot exactly be described as favorable in the medium term.

23 February 2022, © Goldberg & Goldberg for boerse-frankfurt.de

Sentiment Index of Institutional Investors

| Bullish | Bearish | Neutral | |

| Total | 52% | 28% | 20% |

compared to last survey | +6% | +3% | -9% |

DAX (change from previous survey): 14.800 (-650 points)

Börse Frankfurt Sentiment Index Institutional Investors: +24 points (previous survey: +21 points)

Sentiment-Index private investors

| Bullish | Bearish | Neutral | |

| Total | 45% | 41% | 14% |

compared to last survey | -1% | +10% | -9% |

DAX (change from previous survey): 14.800 (-600 points)

Börse Frankfurt Sentiment Index Private Investors: +4 points (previous survey: +15 points)

More articles from this columnist

| Time | Title |

|---|