Market sentiment: "No real Ash Wednesday yet"

The DAX seems to be gradually running out of steam. However, the setbacks are still limited, which seems to suit the majority of investors anyway.

Zusammenfassung

Since our last survey, the DAX had made another attempt to mark a new high for the year last week. But at the crucial moment, it lacked the upward momentum to do so. Instead, there have been setbacks over the past few days, albeit on a manageable scale so far. As a result, the sentiment of the institutional investors we surveyed has not changed all that much, as the majority of them are betting on more significant price declines. At least, according to Joachim Goldberg, the DAX still seems to be benefiting from international capital inflows and is therefore still doing quite respectably.

22 February 2023. FRANKFURT (Börse Frankfurt). Since our last sentiment survey, the DAX has once again attempted to mark a new high for the year. But this attempt failed, because the stock market barometer ran out of steam just before the aforementioned mark (around 15,658 points) last week. Although there was no violent, but a setback, which at times amounted to about 2.5 percent. At the time of the survey, we note a minus of 0.8 percent in the point comparison.

At the same time, the comments of many strategists were once again significantly more negative, with a great deal of skepticism evident above all with regard to U.S. equities. Not least because fears of inflation and thus expectations of rising interest rates increased further during the period under review. Last week's Bank of America survey of global fund managers had also revealed high inflation as by far the biggest extreme risk - with 40 percent of respondents saying so. Interestingly, the second biggest risk, which was named by 17 percent of fund managers in this survey, has hardly been reflected in stock market prices: the fear of a deterioration in the geopolitical situation. At least, this fear is hardly cited as a cause for falling share prices at present.

Too little movement for buybacks

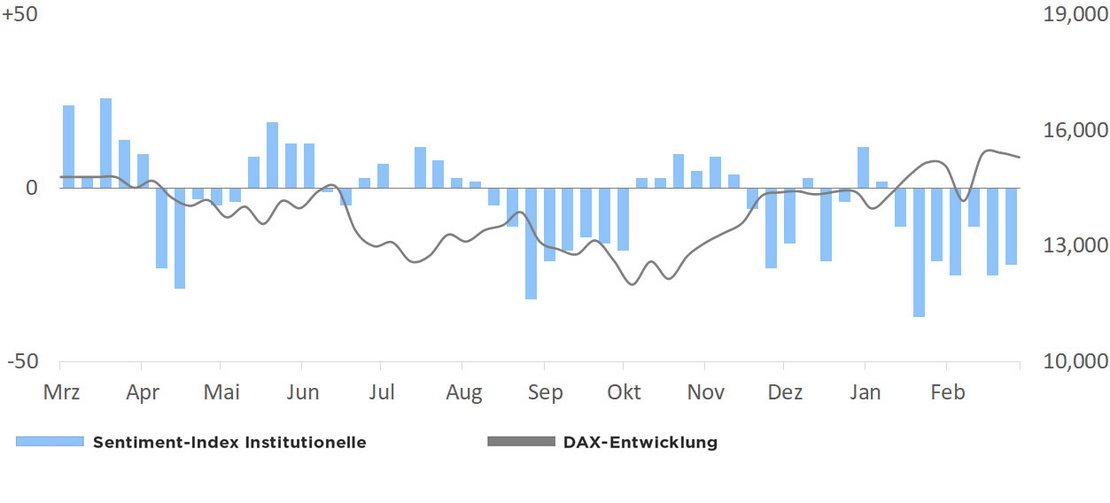

Meanwhile, little has changed in the sentiment of the institutional investors we surveyed with a medium-term trading horizon. Our Börse Frankfurt Sentiment Index rose by only 3 points to a new level of -22. Thus, sentiment remains thoroughly skeptical. The improvement in the index is due to a small percentage of formerly neutral players (3 percent of all respondents) who have turned to the bull side. The fact that practically nothing has happened among the pessimists compared with the previous week is also due to the fact that the affected exposures may have been under water at times during the past trading days; at least, the recent decline in the DAX has not been enough to tempt the bears to buy back on a larger scale so far.

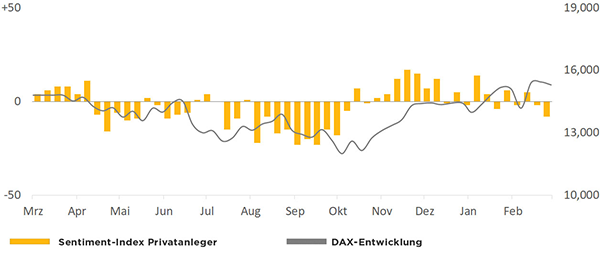

Among private investors, on the other hand, there has been somewhat more movement. Although the Börse Frankfurt Sentiment Index fell by only 6 points in this panel to a new level of -8, it is still the lowest index level since September 21 last year. The biggest change was among the pessimists, whose grouping rose 5 percentage points to its highest level this year. Incidentally, 80 percent of the new bears come from the camp of previously neutral investors, with the remainder being fed by former bulls.

DAX internationally still in demand

Today's survey makes it clear that the pessimists have not yet really gotten their money's worth this month. In fact, measured against the year-to-date highs in February, the DAX has actually fared better than, for example, the broad-based U.S. equity index S&P 500 and has so far suffered a much smaller setback compared to the latter.

Thus, the sentiment situation for the DAX does not remain unfavorable, as the remaining pessimists from today will presumably only report back as demanders in the event of more significant price declines (presumably just below 15,000 DAX points). Especially since the DAX - albeit on a small scale - is currently still likely to benefit from international capital inflows. However, should these fail to materialize - for example as a result of a massive drop in the price of U.S. securities - the aforementioned demand from domestic investors is unlikely to be sufficient to help the DAX get back on its feet in the event of a fall.

22 February 2023, © Goldberg & Goldberg für boerse-frankfurt.de

Sentiment index institutional investors

| Bullish | Bearish | Neutral | |

| Total | 28% | 50% | 22% |

To last survey | +3% | unch. | -3% |

DAX: 15.300 (-130 p to last week)

Börse Frankfurt Sentiment-Index institutionals investors: -22 p (+3 p to last week)

Sentiment-Index privater Anleger

| Bullish | Bearish | Neutral | |

| Total | 34% | 42% | 24% |

To last survey | -1% | +5% | -4% |

DAX: 15.300 (-130 p to last week)

Börse Frankfurt Sentiment-Index institutionals investors: -8p (-6 p to last week)

About the Börse Frankfurt Sentiment-Index

The Börse Frankfurt Sentiment Index ranges between -100 (total pessimism) and +100 (total optimism), the transition from positive to negative values marks the neutral line

More articles from this columnist

| Time | Title |

|---|