Market sentiment: "Enough waiting"

German blue chips are holding in positive territory, causing some professionals to give up and private individuals to cash in. This worsens the situation for further price gains, Goldberg assesses the sentiment.

Summary

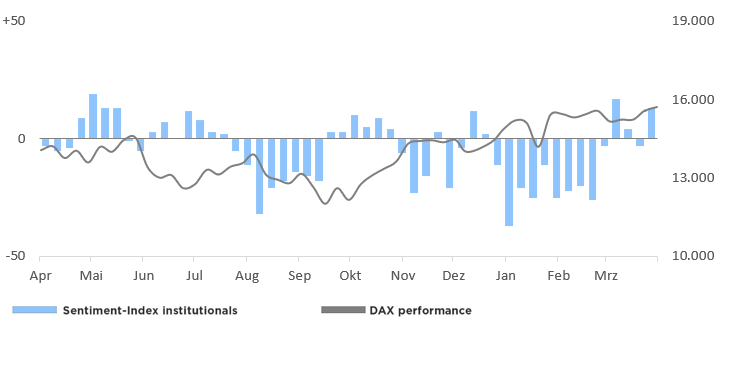

The DAX continues to rise and at least professional investors seem to have had enough of skepticism. 7 percent have entered the stock market, and a full 9 percent have closed short positions. The sentiment index rises to +13 points. The private investors are a different story: 3 percent have sold shares, 4 percent have switched to the short side. The sentiment barometer of this group falls to +3 points. Joachim Goldberg suspects profit-taking in this case. The professionals may simply have run out of patience despite the "justified" skepticism in the market coverage. In the behavioral economist's view, the bears had been underwater for some time.

The bottom line is that today's survey represents a slight burden for the DAX. On the upside, Goldberg expects profit-taking by the bulls from 16,000 DAX points, on the downside, support is now lacking from 15,330/15,380.

12 April 2023. FRANKFURT (Börse Frankfurt). Now, due to the Easter holidays, the trading range of the DAX has remained comparatively low at 1.6 percent, almost as expected. What is striking, however, is that at the time of the survey, the stock market barometer not only failed to post a weekly loss for the fourth time in succession, but was almost at its high for the year. This is remarkable in that market commentary continues to be predominantly - and quite justifiably economically - skeptical in nature. However, it is not only growth concerns or heightened tensions between China and Taiwan that are weighing on the minds of many strategists and commentators. The start of the 2023 reporting season in the U.S. next weekend is also casting its shadow. And on a street corner one could hear that one should not stick so rigidly to the stock market rule "Sell in May" and wait until then to sell shares, but rather start doing so in April as a precaution.

Now, on superficial inspection, one could well have gotten the impression that the pessimistic majority of institutional investors last Wednesday would not normally be put off by a slightly rising DAX (a point comparison shows a weekly increase of 0.8 percent). But in contrast to many skeptical comments, the investors we surveyed with a medium-term trading horizon have clearly changed their assessment and apparently lost patience. For our Börse Frankfurt Sentiment Index has risen by 16 points to a new level of +3. At the same time, the bear camp has been reduced by 9 percentage points, with more than three quarters of the former pessimists turning directly to the bulls, i.e. turning their engagements by 180°. As a result, the Börse Frankfurt Sentiment Index is at its second highest level this year; only three weeks ago was the mood even better.

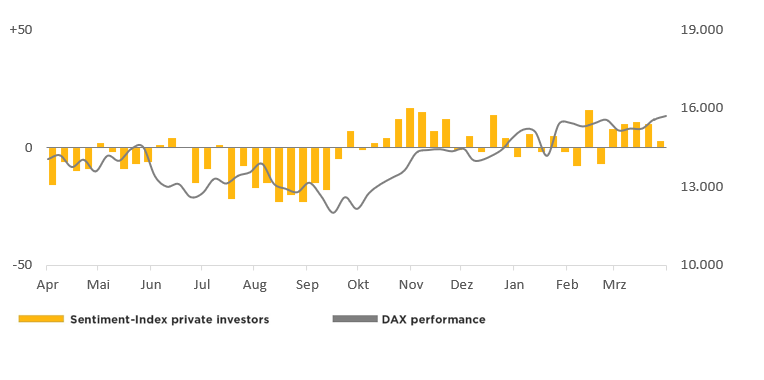

Private investors with a more favorable starting point

Among private investors, however, there has been a development in the opposite direction. In this panel there has been profit-taking by previously optimistic investors. Our Börse Frankfurt Sentiment Index fell by 7 points to a new level of +3. Within this movement, the group of optimists has shrunk by 3 percentage points, whereby most of them have not only been content with profit taking, but have gone directly to the bear side - the latter has also experienced a small increase by previously neutral players.

With today's sentiment survey, there is thus still a gap in sentiment between private and institutional investors, albeit with the sign reversed. The former are now less optimistic than their institutional counterparts. On the other hand, it is clear that the recent rise in the DAX could well be home-made, precisely by institutional investors, who have changed their attitude significantly for the better.

Cautiously optimistic

Even though the optimism of institutional investors determined today is at the second highest level of this year, one can still not speak of a euphoric mood. This is also evident in the relative view on three and six months, even if overall this results in higher index values than in the absolute view, not least because the players still show a basic pessimism in the longer term. But even here, these are only the second highest values this year.

Nevertheless, today's survey represents a burden for the DAX, albeit not a critical one per se, as profit-taking would probably set in on the upside just above 16,000 DAX points at the latest. In the same course, the bottom side is poorly supported due to the recent position changes below 15,330/15,380.

12 April 2023, © Goldberg & Goldberg für boerse-frankfurt.de

Your opinion counts: market expectations of investors

All interested investors are invited to participate. It only takes 15 seconds. You will receive an email with a survey link every Tuesday. You will receive the results of the analysis by email.

Sentiment-Analyse jetzt auch als Podcast

Sie können sich die Sentiment-Analyse direkt über diese Seite anhören oder herunterladen. Es gibt sie natürlich auch auf den üblichen Podcast-Plattformen Spotify, iTunes, Podcaster, Amazon, Google, auf denen Sie ihn abonnieren können.

Sentiment-Index institutional investors

| Bullish | Bearish | Neutral | |

| Total | 42% | 29% | 29% |

| To last survey | +7% | -9% | +2% |

DAX: 15.700 (+125 points)

Börse Frankfurt Sentiment index institutional investors: +13 points (+16 points to last week)

Sentiment-Index private investors

| Bullish | Bearish | Neutral | |

| Total | 40% | 37% | 23% |

To last survey | -3% | +4%. | -1% |

DAX: 15.700 (+125 points)

Börse Frankfurt Sentiment index institutional investors: +3 points (-7 points to last week)

About the Börse Frankfurt Sentiment Index

The Börse Frankfurt Sentiment Index ranges between -100 (total pessimism) and +100 (total optimism), the transition from positive to negative values marks the neutral line

More articles from this columnist

| Time | Title |

|---|