Exchange-Traded-Funds

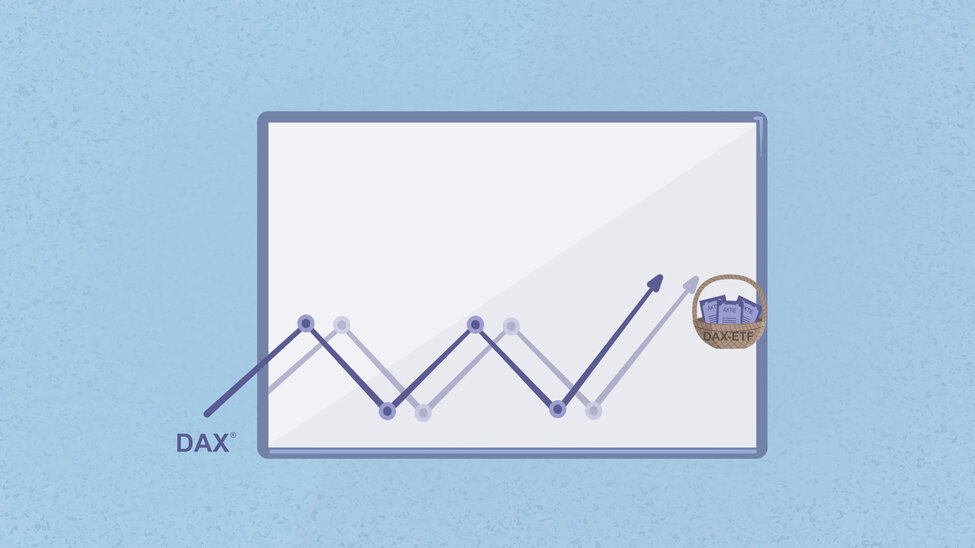

With ETFs, you do not invest in a single company, but in the entire basket of securities in an index.

Exchange-traded funds, or ETFs for short, are exchange-traded investment funds that reflect the performance of an index, commodity market or industry.

An ETF is a package that contains the securities of an index. This type of fund has been traded on the Frankfurt Stock Exchange since 2000. If, for example, you invest in a DAX-ETF, then you own shares in all 30 shares in the DAX and your investment develops parallel to the DAX. If the DAX rises, so does the price of your fund.

ETFs thus combine the tradability of a stock with the risk diversification of a broadly diversified portfolio. You invest in a basket of various securities and thereby spread your risk over several positions with one order, thereby reducing it. Because ETFs are easy to understand, transparent, fast and inexpensive to trade, they have become the fastest growing investment type of the past decade.

An ETF thus combines the securities of an entire market into one security. There are ETFs for individual countries, different regions or with many companies worldwide, different asset classes, individual sectors or sophisticated strategies.

The most important difference from a traditional investment fund is that there is no need for a fund management company to make active investment decisions. An ETF strictly adheres to the composition of the underlying index. This investment strategy is therefore called passive. Without active management, ETF fees are usually much lower.

As is the case with exchange-traded investment funds, of which there are also around 3,000 on the Frankfurt Stock Exchange, ETFs do not incur any issue surcharges or redemption fees. They have to pay the usual transaction costs for buying and selling. And the ETF's management fees, which for a DAX-ETF average only around 0.1 percent per year. These fees are automatically taken from the investment fund.

Full and synthetic replication: the different ETF types

As already mentioned, ETFs track markets via indices. For this replication, fund companies can use two different methods: full replication and synthetic replication.

ETFs with full replication:

Full replication means that an ETF actually owns all the securities that are included in the index that the fund tracks. If a fully replicated ETF tracks the performance of the DAX, then it contains the 30 shares of the DAX with the same weighting as in the index. This is done by buying and selling the corresponding shares of the companies included in the index.

ETFs with synthetic replication:

Synthetic ETFs, on the other hand, do not track an index with the underlying stocks. Rather, they track the performance of the underlying index through the use of derivative financial instruments.

Why is this done? Primarily to reduce costs for investors. In the case of indices that contain many shares and are frequently adjusted, the ETF fund company must buy and sell shares. This involves costs, taxes and other fees. These costs are reduced by artificial replication.

For this purpose, the fund company uses swaps with a partner. The share of swaps in an ETF is limited by law and synthetic ETFs do not have any disadvantages. However, many investors feel uncomfortable knowing that their German equity ETF could hold Chinese bonds, for example. Some investors, foundations and municipalities, for example, are not allowed to invest in such instruments. This is why replicating ETFs are now mainly offered.

Protected against default as a special fund

ETFs are like traditional funds special funds. This means that neither the fund company nor the creditors have access to the money invested. In the event of the fund company becoming insolvent, you as the investor will not incur a loss.

How to find the right ETF

First of all, you should consider which market you would like to invest in and which index reflects this market. Online brokers and financial portals provide search engines for this purpose. On boerse-frankfurt.de you will find thematically structured lists of all 1,200 ETFs on the stock exchange. Of course you can also contact your bank advisor.

In addition to a one-off investment in one or more ETFs, banks also offer ETF savings plans. Here you can purchase ETF shares starting at 25 euros per month. Due to the constant amount, you acquire more units at low prices and fewer units at high prices.

First Steps

- In search of returns

- How the stock exchange works

- Shares - Participating in companies

- Guide to stock selection

- Share facts - always being informed

- The Stock Exchanges of Deutsche Börse

- The share price is determined as follows

- Basic rules for shareholders

- Let's go: Open a depository

- Place the first order

Other asset classes

Do you have any Questions?

Ask us online!

- boerse-frankfurt@deutsche-boerse.com

- Hotline +49 (0) 69 211 18310