Markets and segments

Market structure of Frankfurt Stock exchange

The choice of market and segment not only determines how a company communicates with its investors and the public before going public.

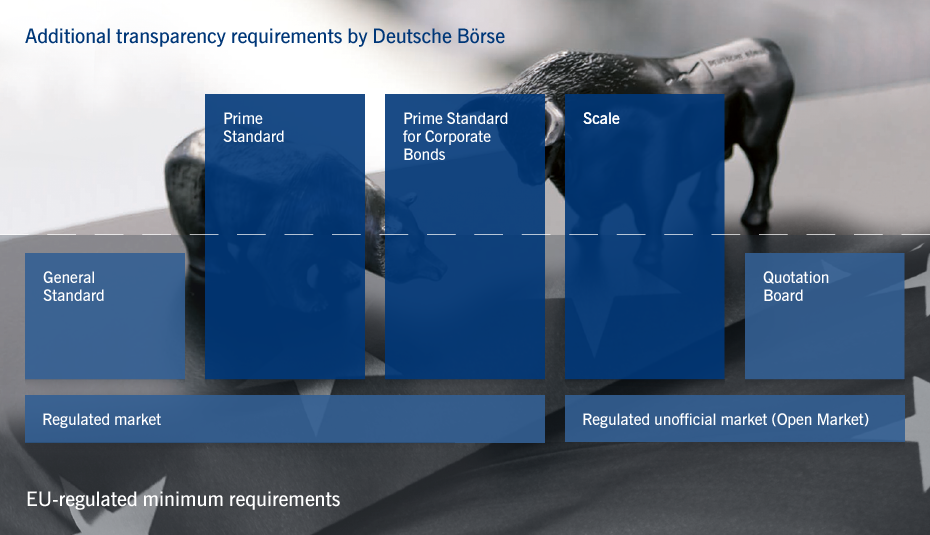

On the Frankfurt Stock Exchange, companies can access the capital market in two ways in accordance with European rules. These are markets that are regulated by the EU on the one hand and markets that are regulated by the stock exchanges themselves on the other.

In Frankfurt, an IPO in the Regulated Market leads to the General Standard or the Prime Standard, both sub-segments of the Regulated Market with additional post-admission obligations and increased transparency requirements. In the Open Market, which is regulated by the stock exchange itself, companies can choose the Scale segment or be included in the Basic Board with no further transparency requirements.

The companies decide on a segment and thus on the transparency level themselves.

Segments ensure flow of information

Investors demand transparency, liquidity and legal certainty. Clear and unambiguous regulations ensure a functioning capital market, because only then do investors invest their money in companies. The rules that offer investors legal certainty and transparency are thus defined either by the legislator or by the stock exchange.

The regulated market is anchored in public law (Securities Trading Act, WpHG for short). Admission conditions and transparency requirements are specified by the European legislator. Companies in the Regulated Market meet the highest European transparency requirements and secure all the advantages of a full stock exchange listing.

The Regulated Unofficial Market, which was renamed Open Market in October 2005, with its sub-segment Scale, is a segment under private law. Here the shares are included in trading. Since the conditions for inclusion in trading are low and there are hardly any follow-up obligations, Scale provides small, medium-sized or young companies with easy and cost-effective access to the capital market. However, it is also primarily aimed at qualified investors. In March 2017, the Scale segment replaced the Entry Standard. All other Open Market companies were included in the Quotation Board.

© August 2019, Deutsche Börse AG