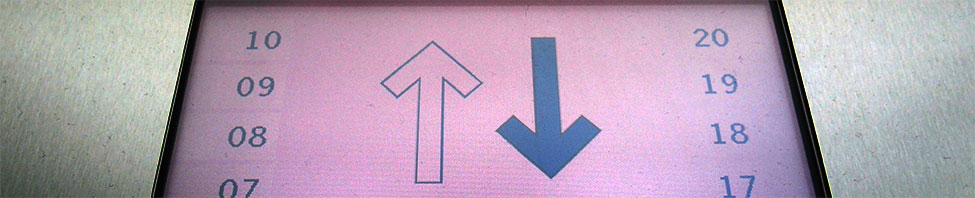

Who comes in, who has to leave

The index adjustment process

Every three months, a decision is made as to which companies are to be included in the DAX, TecDAX, MDAX and SDAX selection indices or must leave them. The regular reviews and adjustments follow a strictly regulated procedure. The question of who moves up, who moves down and who moves up, who moves down and who moves down is definitely a matter for the individual shares and not infrequently for the entire market.

Transparent rules

Clear rules determine whether a company should be included or whether it should leave an index. In order to be included in the important selection indices, companies must meet the transparency requirements of the Prime Standard, be continuously traded on Xetra, have a registered office in Germany or carry out a substantial part of their business activities there and hold at least 10 percent of the shares in free float. Currently, a good 600 companies meet the first three criteria.

Since September 2021, which of these are included in the DAX, MDAX and SDAX has depended solely on the market capitalization of the shares in free float. Until the latest reform, order book turnover also played a role.

The TecDAX has included the largest technology stocks since September 2018. For other indices, qualitative factors such as sector affiliation or dividend yield are also taken into account.

The procedure

There are two different approaches to evaluation: The regular review and the stricter Fast Exit/Fast Entry. For the DAX, for example, a company must be one of the 40 largest stocks in terms of order book turnover or market capitalisation in the regular review, and the 33 largest in terms of fast entry.

The DAX, MDAX and TecDAX are regularly reviewed and adjusted twice a year, in March and September. The SDAX is reviewed quarterly. The rules for quick entry or exit, on the other hand, take effect quarterly for all indices.

In addition, there are extraordinary adjustments, for example if companies merge, become insolvent or their free float is drastically reduced.

New rules for the DAX

The index reform 2020/2021 has added a number of requirements for inclusion in the DAX: Listing on the Regulated Market is sufficient, positive EBITDA, financial reporting obligations with defined sanctions for non-compliance, installation of an audit committee, liquidity requirements.

Four times a year, on the third working day in March, June, September and December is the index date, which is when the upcoming changes are published after the close of trading in the US. The underlying ranking of companies is based on the closing prices of the previous Friday. The changes will take effect about three weeks later.

A look into the glass ball

No reliable statement about the new index compositions can be made prior to this publication. Nevertheless, many media deal with the topic and calculate the results themselves. Anyone can do this because the guidelines for the index compositions are clearly defined and based on available market data.

Then it's mixed

The mathematical process of recomposition is called concatenation. The weighting with which the individual stocks are represented in the index is based on the closing prices of the third Friday in the month under consideration. Capital changes and dividend payments from the previous period are also included. The dates are consistent with the expiration dates on the Eurex futures and options exchange on which the index futures and options expire on these same Fridays. The changes will take effect on the following trading day.

© Deutsche Börse, September 2021